In the article on candlestick patterns part 3, we will understand about Marubozu candlesticks, these candlesticks have characteristics that speak of strong signals of the market, let’s learn about these candlesticks with Blackmantrader.

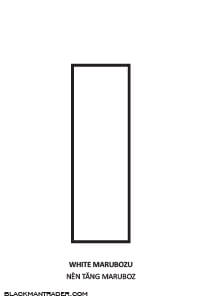

BASIC CANDLESTICK PATTERN: MARUBOZU BULLISH CANDLESTICK

Describe:

The candlestick body is short, without shadows, the opening price hits with the lowest price and closes with the highest price

Price action:

Very strong uptrend

Advice:

If it emerges after a long decline and is near an important resistance support level, this is a very potential reversal signal. If it appears after a long rally, it may be entering high-risk territory or overbought

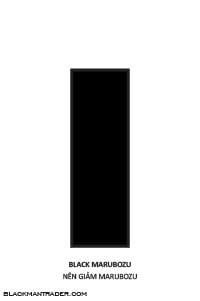

BASIC CANDLESTICK PATTERN: MARUBOZU BEARISH CANDLESTICK

Describe:

The body of the candlestick is long, without shadows, the door apricot’s price coincides with the highest price and the closing price coincides with the lowest price.

Price action:

The downtrend is very strong

Advice:

If it emerges after a long rally and near an important resistance support level, this will be a very potential reversal signal. If it appears after a long decline, it is possible that the price is entering the high-risk zone or oversold

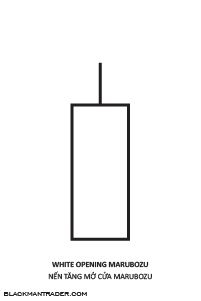

BASIC CANDLESTICK PATTERN: BULLISH CANDLESTICK OPENS MARUBOZU

Describe:

The candlestick body is long, there is no lower shadow, the closing price is higher than the opening price

Price action:

The uptrend is very strong, the buyers have completely dominated the market

Advice:

Should emerge after a long fall and near an important resistance support level. Reversal signals are very potential. If it appears after a long rally, the price is entering the high-risk zone or overbought. It is necessary to combine with neighboring candles to increase performance.

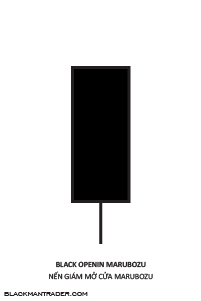

BASIC CANDLESTICK PATTERN: MARUBOZU OPENING BEARISH CANDLESTICK

Describe:

The body of the candlestick is long, there is no upper shadow. The closing price is lower than the opening price

Price action:

The downtrend is very strong, sellers have completely dominated the market.

Advice:

If it emerges after a long rally and is near an important resistance support level, a reversal signal is very potential. If it appears after a long decline, the price is entering the high-risk zone or oversold. It is necessary to combine with neighboring candles to increase performance.

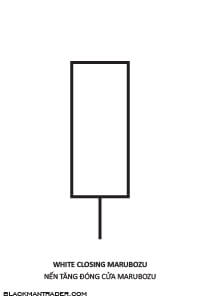

BASIC CANDLESTICK PATTERN: BULLISH CANDLESTICK CLOSES MARUBOZU

Describe:

The candlestick body is long, there is no upper shadow, The closing price is higher than the opening price

Price action:

The uptrend is very strong, buyers have completely dominated the market.

Advice:

If it emerges after a long fall and is near an important resistance support level, a reversal signal is very potential. If it appears after a long rally: the price is entering the high-risk zone or is overbought. It is necessary to combine with neighboring candles to increase performance.

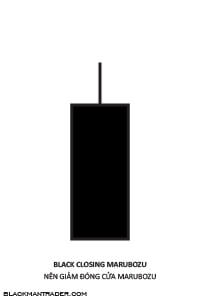

BASIC CANDLESTICK PATTERN: MARUBOZU CLOSE SHOULD BE REDUCED

Describe:

The body of the candlestick is long, there is no lower shadow. The closing price is lower than the opening price.

Price action:

The downtrend was very strong, the buyers completely dominated the market.

Advice:

If it appears after a long rally and is near a key resistance support level: a reversal signal is very potential. If it appears after a long decline: the price is entering the high-risk zone or oversold. It is necessary to combine with neighboring candles to increase performance.