In August, Gold fell deeply to 1885, after several tests of this price zone, Gold made a bottom here and bounced back sharply to close the May candlestick around 1940. Blackmantrader’s perspective on the Gold market in the coming time is as follows:

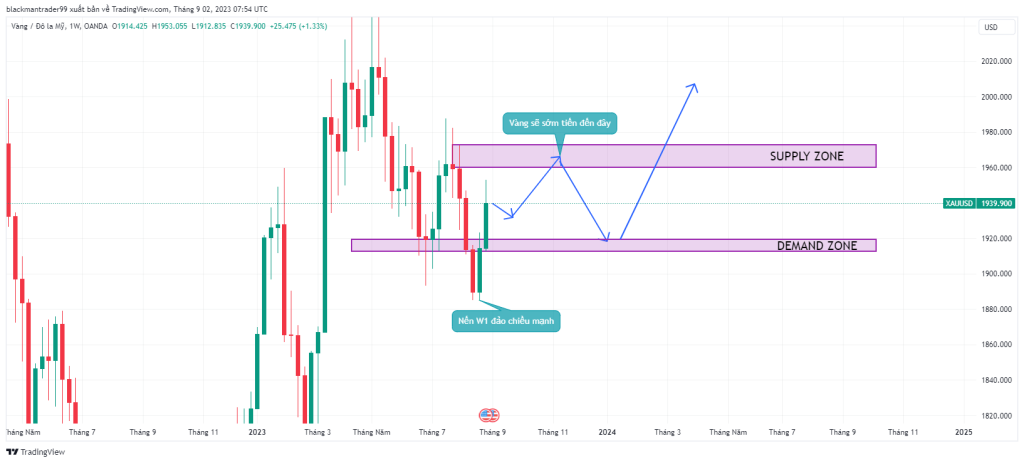

+ Long-term: observing the monthly frame, we see that the candlestick that has just closed has retreated very long legs, showing that strong buying force has appeared => The probability of the Gold market rising again is high, we can expect to return to the 20xx zone in the last quarter of this year. In order for Gold to reach the 20xx zone in the near future, Gold needs to have 1 retest around 1918 to absorb more force from the bulls below to continue to break through strongly.

+ Medium term: when touching 1885, W1 candlestick closed 1 Engulfing candlestick sharply rising again, covering the previous bearish candlestick => Showing the market reversing the trend from bearish to bullish, Gold continued to rise strongly until 1952 over the weekend. According to Blackman, Gold will soon arrive in 1964 this September. Here the market will level off and fall deeply 1 more time, then can break out sharply upwards.

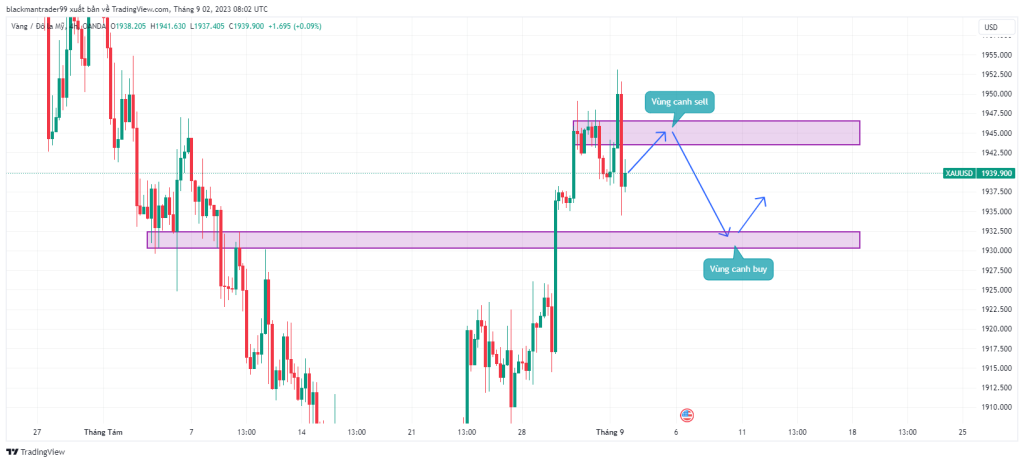

+ Short-term: after a sweep to 1952 Gold reversed to 1934 – Touching the Demand Zone created at the H4 timeframe, the market rebounded at the end of the US session and closed the D1 candlestick around 1939 with 2 long antennae accompanied by a very small body => Showing the market’s hesitation when it is close to the upper barrier is 1948.

This Monday, the possibility of Gold breaking the 1948 barrier to increase is very low => Based on the factor that D1’s strong rally upwards has reversed + W1 has also withdrawn its beard, so Blackman will watch the main sell. According to Blackman, the market will soon rebound to 1945-1947 and there will be a reversal signal here, selling will push Gold back to 1930 during the week.

Command reference:

Sold 1945- 1947

SL 1953

TP1: 1941

TP2: 1935

Buy 1931

SL 1924

TP 1940