In part 1 of basic candlestick patterns Blackmantrader has introduced to you some basic candlestick patterns, in part 2 today, Blackmantrader will continue to introduce to you 4 more basic candlestick patterns to help you have more knowledge to be able to confidently trade any market

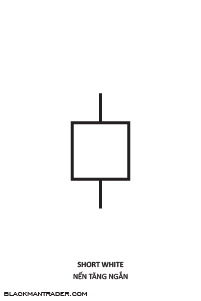

BASIC CANDLESTICK PATTERN: BULLISH CANDLESTICK SHORT RISE

Describe:

The candlestick body is short, the closing price is higher than the opening price

Price action:

Buying pressure is weak, price volatility is limited.

Advice:

Bullish candlesticks when standing alone hardly give any significance to note. The market is only maintaining the current trend. There is no notable news or upheaval at this time.

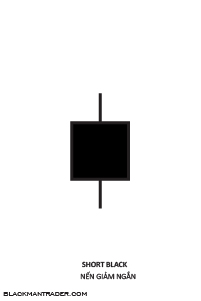

BASIC CANDLESTICK PATTERN: SHORT BEARISH CANDLESTICK

Describe

The candlestick body is short, the closing price is lower than the opening price

Price action

Selling pressure is weak, price volatility is limited

Advice:

A short bearish candlestick when standing alone hardly gives any significance to note. The market is just maintaining the current trend. There is no news or upheaval in the spotlight at this time.

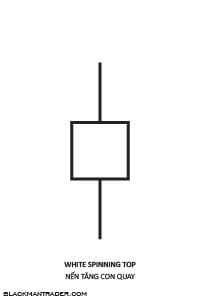

BASIC CANDLESTICK PATTERN: GYROSCOPE BULLISH CANDLESTICK

Describe:

The body of the candlestick is very small compared to the shadow, the closing price is higher than the opening price

Price action:

The upper and lower shadows are both much longer than the body, indicating the hesitation of both sides

Advice:

Signals a decline or disruption in the price trend

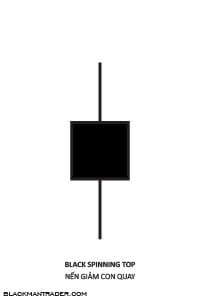

BASIC CANDLESTICK PATTERN: GYROSCOPE BEARISH CANDLESTICK

Describe:

The body of the candlestick is very small compared to the shadow, the closing price is lower than the opening price

Price action:

The upper and lower shadows are both much longer than the body, indicating the hesitation of both sides

Advice:

Signals a decline or disruption in the price trend