The content of the article

In the financial market, Japanese candlesticks play a very important role in judging and determining market trends. Japanese candlesticks are used to describe price action, or exchange rate movements as well as describe traders’ sentiment thanks to 4 pieces of information appearing in 1 trading session.

Let’s learn about the basic concepts of Japanese candlesticks with Black Man Trader.

The origin of the formation of Japanese candlesticks

Munehisa Homma (1724-1803) was also known as Sokyu Homma. He was a rice merchant in the Sakata region of Japan and used to sell rice at the Ojima rice market in Osaka during the Tokugawa Shogunate dynasty.

Trading the rice futures market early in the 1700s, he realized that although there was a link between supply and demand in the rice market, the market was strongly influenced by traders’ emotions. He reasoned that studying market sentiment could predict the direction of rice prices. In other words, he recognized the difference between the value and the price of rice. The difference between value and price is very similar to today’s stocks, bonds, currencies.

In 1755, he wrote San-en Kinsen Hiroku (The Origin of Gold – Monetary Yearbook), the first book on market psychology. In this book, he argues that the psychological side of the market is critical to business success and that traders’ emotions have an important influence on rice prices. He noted that this could be used to orient oneself toward the market. When all markets are in a downward trend, there will be reasons why rice prices go up and vice versa.

The Japanese candlestick pattern was born and it is also known as Sakata, Mr. Homma carefully recorded the price of rice moving each day with candles. He realized that there was an astonishing repetition when looking at his recorded history. From there, he was able to predict future rice prices to hoard goods and using Japanese candles gave him a huge advantage over the merchants of the time.

He described the rotation as “positive” (Yang) and “negative” (Yin: bear market). He used weather and trading volume as well as prices to simulate trading positions. He is considered the most successful entrepreneur in history, making profits of more than $100 billion in today’s value, earning more than $10 billion a year in a few years.

What is the structure of Japanese candlesticks?

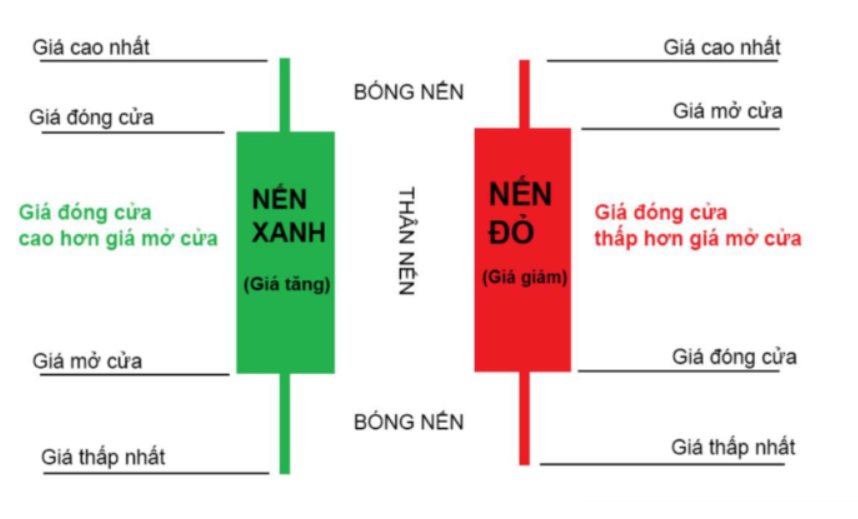

Japanese candlesticks have a simple structure with a rectangular box that is the body and a line above and below the body called a candlestick shadow, there are three points to pay attention to when looking at candlesticks: closing point, opening and shadow. (Illustration)

Each candlestick represents the price movement of a certain period of time when you choose to look at the chart.

From the Japanese candlestick trading session as above, each candlestick will provide traders with 4 main information, before moving on to 1 other candlestick to continue recording price data:

- Closing price

- Opening price

- The highest price of the session

- The lowest price of the session.

So 1 standard Japanese candlestick will have to have 3 parts including:

- Upper candlestick: the highest price of the session

- Lower candlestick: lowest price of the session

- Body or candlestick: the part is displayed in 2 colors green and red, showing the range of prices that fluctuated from opening to closing, over a specific period of time.

Where:

- The opening price is LESS than the closing price >>> Green Candlestick >>> Price increases

- The opening price is GREATER than the closing price >>> Red candlestick >>>> Price falls

From these two blue and red colors will make the part of the opening price, the closing price, set 2 other positions

- Green candlestick (bullish candlestick) The opening price is below, the closing price is above

- Red candlestick (bearish candlestick) The opening price is above, the closing price is below

How does Japanese candlestick size affect the market?

As a result, many different Japanese candlesticks will be produced, with only 4 price information mentioned above. Or the price sentiment has helped Japanese candlesticks form many different sizes, big, small, large, small, tall, skinny. And relying on this very shape will provide traders with the thoughts of the 2 factions, what state they are in, to “know the way”!

To better understand the basic candlestick patterns, let’s go to Black Man Trader Basic Candlestick Patterns Part 1

In what year are Japanese candlesticks formed?

Japanese candlestick formed in 1755 in Japan

How many types of Japanese candlesticks are there?

There are 2 main types of Japanese candlesticks: bullish candlestick and bearish candlestick