What is Forex? Forex (FX) is an acronym for Foreign Exchange which means international currency exchange. The Forex market (foreign exchange market) is the place where currency exchange activities of countries take place through banking systems and credit institutions.

Forex is considered the largest, most liquid financial market with a trading volume of up to $5.1 trillion per day (according to a World Bank report). This number will increase as the Forex market grows stronger.

What is forex trading? Forex trading is simply understood as buying and selling currency pairs on the Forex market with the aim of making a profit from the price difference. However, depending on the form of centralized or decentralized trading, people are divided into the following 2 forms of Forex trading:

* For centralized markets: Forex trading is the process of exchanging and buying and selling currencies of countries around the world with each other. The difference between buying and selling currencies is the profit that investors will receive. In this case, investors will transact through banks and credit institutions… To put it more simply, when you buy and sell dollars outside of Gold stores, those currency exchange points are foreign exchange trading.

* For over-the-counter markets: FX trading is buying and selling currency pairs that are already listed. At that time, traders will predict whether the exchange rate will rise or fall to enter Buy or Sell orders. Unlike centralized markets, traders only profit when prices rise, while in this market traders can make profits even when prices fall.

More specifically, trading Forex on brokers with very high leverage advantages helps us to have little capital but still be able to earn high profits. You can refer to reputable Forex brokers here.

* Forex portfolio: In the Forex market, investors can not only trade currency pairs but also diversify their portfolio with many other products such as:

* Currency pairs: These include major currency pairs in Forex (EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, USD/CAD, NZD/USD), cross currency pairs (EUR/GBP, EUR/JPY, GBP/JPY, EUR/AUD…) and exotic currency pairs (a combination of 1 major currency and 1 currency of an emerging economy country such as: India, Mexico, Brazil…).

* Metals: Precious metals such as gold, silver, platinum, palladium.

* Commodities: Agricultural products such as coffee, sugar, wheat ,…

* Energy: Trade popular energy products such as crude oil, oil and gas, gas, WTI oil,…

* Stocks and indices: Many stock codes and stock indices of major companies around the world.

* Cryptocurrencies: Trade popular and influential cryptocurrencies such as BTC, ETH, LTC, LINK…

*Forex market participants The forex market involves many stakeholders such as: central banks, commercial banks, companies, currency funds, Forex brokers and retail traders… To be clear, the Forex market is the largest financial market that every country participates in to exchange its main product, which is currency.

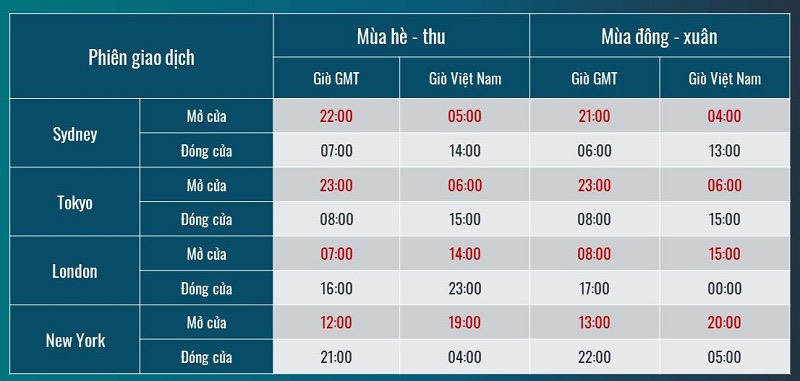

* . Trading hours on the forex market The Forex market is open 24 hours a day, 5 days 1 week from 2nd to 6th. Forex market operating hours are calculated in international time, the first opening session is the Sydney session (Australian session), then the Tokyo session (Asian session), London session (European session) and New York session (American session). Trading sessions are continuous and consecutive.

* The opening and closing times of seasonal and Vietnam time Forex trading sessions are as follows:

Why does forex appeal to so many people?

The Forex market is growing, leading to thousands of participants every day. This proves that the Forex market has a huge attraction for investors all over the world. So why is the Forex market so attractive? Please refer to the following reasons:

* High liquidity: Forex is considered the most liquid market, with a daily trading volume of up to 6 trillion USD, the largest of the financial markets today.

* Unlimited trading time and position: Investors can trade on the forex market 24/5, starting from 4am on Monday until 4am on Saturday, no matter where you are in the world.

* Two-way trading: Investors can open buy or sell orders in any situation and can completely make profits even when the market goes up or down.

* Leverage allowed: The Forex market allows the use of extremely high leverage, up to 1:2000. Leverage helps investors minimize their initial capital and have the opportunity to increase profits significantly. However, the use of leverage also carries huge risks, so investors should be aware.

* High transparency: The Forex market has the participation of many large institutions, investors around the globe, so no one can manipulate it, including central banks.

* No barriers to capital: Currently, forex brokers allow traders to open accounts with a very small minimum deposit, moreover, you can use leverage.

* No commission: To attract investors, many exchanges charge almost no commission or brokerage fees.

* Low spreads: The spread (bid/ask spread) in the forex market is considered relatively low, lower than 0.1 under normal market conditions. Even this fee is reduced to zero. Conclusion Thus, through the above article, you have a clear understanding of what forex is as well as information related to the Forex market. Hopefully, this information can help you make a choice whether or not to invest in Forex. However, Forex is a “high risk high return” market, so prepare yourself with good knowledge to stand firm in this market!